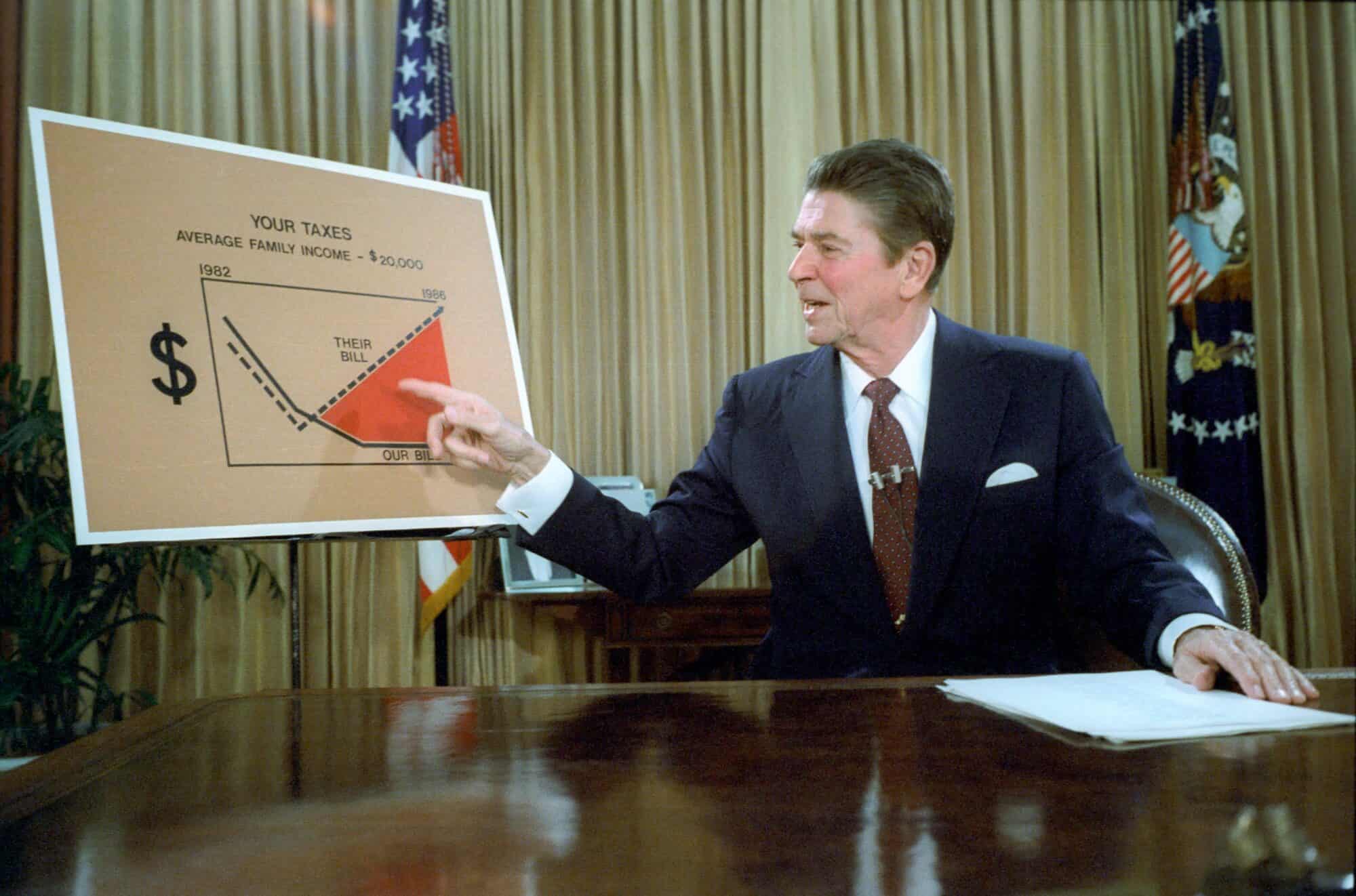

Lance Taylor and Ozlem Omer have just published an important new book, Macroeconomic Inequality from Reagan to Trump (Cambridge University Press). A non-technical summary can be found on the website of the Institute for New Economic Thinking.

Their core argument, based upon a close analysis of the United States macroeconomic data, is that rising economic inequality is the root cause of persistently low rates of investment and growth, the phenomenon known as secular stagnation. Extreme inequality also explains why the economy has stagnated despite a decade and more of very low interest rates which might otherwise have been expected to spur private and public investment, and thus higher productivity and more robust growth.

Taylor and Omer argue that the period since about 1980 has been one of persistent wage repression, the result of steadily falling union bargaining power and political influence over issues such as labour rights, the minimum wage and unemployment insurance benefits. Downward pressure on wages has meant that real inflation adjusted wages have risen little for the bottom 90%, and by less than the rate of growth of productivity.

“Wage repression over decades is the basic cause of distributional malaise.”

Taylor and Omer (2020), Macroeconomic Inequality from Regan to Trump.

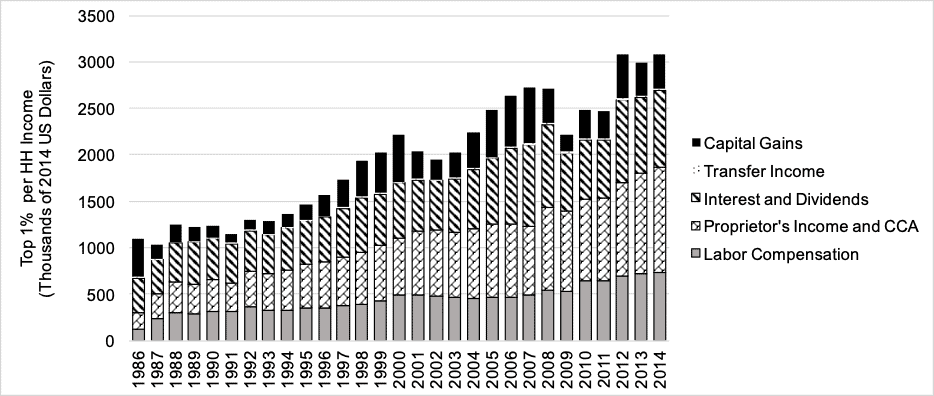

The shift of national income away from wages and the corresponding rise of the profit share which is distributed to the owners of capital accounts for the large increase in the proportion of household income “earned” by the top 1%.

Taylor and Omer calculate that the share of capital in US national income has risen by eight percentage points of GDP since 1970. While the share of labour has correspondingly fallen. This has contributed massively to the rise of the income share of the top 1%, who have household incomes now averaging over $3 million per year and receive the majority of income from capital.

Indeed, 80% of the income of the top 1% of households comes from profits in the forms of interest. Dividends, capital gains, and proprietor’s income. While the rising capital share is the key driver of inequality, the share of wage and salary income going to the top 1% has also risen, mainly reflecting the cashing in of stock options and bonuses by top corporate executives which are counted as wages in the national accounts.

The authors argue that it would take decades of real wage growth in excess of productivity to reverse the sharp rise in the income share of the top 1% — who now get about 20% of all US household income, and own close to 50% of all wealth. Such a fundamental shift would be helped by levying much more progressive taxes on capital income and on wealth

The major macro-economic implication of rising income and wealth inequality is that there has been an increasing tendency for income to be saved rather than invested or spent. The top 1% save about 50% of their rising incomes, vastly more than the bottom 90%, so the rise in their share boosts the overall savings rate. Savings accumulate due to the lack of demand for loans on the part of business, despite ultra low interest rates.

A related problem is that business investment is low due to cheaper capital inputs to production in a post industrial economy which does not make very large material investments in new plant, machinery and equipment, as opposed to in intangibles such as intellectual property and big data.

The argument that extreme economic inequality is a major cause of economic stagnation is not new, but Taylor and Omer connect the dots in the data to confirm the diagnosis. Their analysis suggests that capital has become far too strong to sustain a robust economy and that an increase in labour bargaining power should be welcomed rather than resisted.